cayman islands tax treaty

The Cayman Islands and the United Kingdom also. The Cayman Islands Tax Information Authority.

Copy Of A Review Of Tjn S Financial Secrecy Index

ARTICLE 3 Taxes Covered 1.

. The so-called Pillar Two measures would establish a minimum effective tax rate of 15 on the profits booked by companies in low-tax and zero-tax jurisdictions. The Cayman Islands and the United States signed their Agreement to Improve International Tax Compliance and to Implement the Foreign Account Tax Compliance Act based on the Model 1 IGA in 2013. 6 April 2011 for Income and Capital Gains Tax.

Cayman Islands Foreign Bank Account Reporting The FBAR FinCen Form 114. And b in the case of the Cayman Islands any tax imposed by the Cayman Islands which is substantially similar to the taxes described in subparagraph a of this paragraph. The DTA applies to individuals natural or legal who are residents of one or both jurisdictions.

In addition to having no corporate tax the Cayman Islands impose no direct taxes whatsoever on residents. The Cayman tax is applicable to two types of Belgian tax residents that are founders or third-party beneficiaries of an offshore legal structure namely. 1 individuals that are subject to the Belgian personal income tax.

Income Tax Return for Certain Nonresident Aliens With No Dependents and compute your tax as a nonresident alien. Since then the number of TIEAs that Cayman has in force has proliferated. Agreement between the Government of Japan and the Government of the Cayman Islands for the Exchange of Information for the Purpose of the Prevention of Fiscal Evasion and the Allocation of Rights of Taxation with Respect to Income of Individualsb Japanese English 213KB 75KB See below for the outline of this Agreement.

Cayman signed its first Mutual Legal Assistance Treaty with the USA in the 1980s and has tax information exchange agreements with 36 jurisdictions. The Protocol to the existing DTA and Amending Protocol between Ireland and Germany entered into force on 30 December 2021. Our team of Cayman Islands incorporation agents presents some of the main issues included in the treaty.

F the term company means any body corporate or any entity that is treated as a body corporate for tax purposes or which is otherwise treated as a body corporate under the law of a Territory. I in the case of Canada the Minister of National Revenue or the Ministers authorised representative. US- Cayman Islands Tax Treaty And Cayman Islands Expat Tax.

To accommodate the non-direct tax system of the Cayman Islands the IGA is a model 1B non-reciprocal IGA. Cayman Compass is Cayman News. Automatic data exchange as part of the European Union Savings.

A the term Party means the Cayman Islands or Canada as the context requires. This is entirely untrue. The DTA came into force on 24 February 2022.

The taxes which are the subject of this Agreement are in the case of Canada all taxes on income and on capital imposed or administered by the Government of Canada and in the case of the Cayman Islands all taxes on income and on capital imposed or administered by the Cayman Islands including any taxes on income and on capital imposed or administered after the date. Hereinafter referred to as Chinese tax b in the Cayman Islands. 1 April 2011 for Corporation Tax.

Ii in the case of the Cayman Islands the Tax Information Authority or its. Nonresident Alien Income Tax Return or Form 1040NR-EZ US. After the Cayman Islands was forced to accept information sharing under the EUs Savings Tax Directive in 2004 the UK agreed to move discussion of a tax treaty between the United Kingdom and the Cayman Islands to the head of the queue.

And 2 legal entities which are subject to the Belgian legal entities tax. Does not have a tax treaty with the Cayman Islands and as a result there are no benefits for Cayman Islands Expat Tax from this perspective. Its effective in the UK and the Cayman Islands from.

Together they can exclude as much as 224000 for the 2022 tax year. Hereinafter referred to as Cayman Islands tax This Agreement shall also apply to any identical. B the term competent authority means.

The existing taxes to which this Agreement shall apply are in particular. We maintain a collection of worldwide double tax treaties in English and other languages where available to assist members with their enquiries. We are Cayman Islands most trusted news.

Ii in the Cayman Islands. The Cayman Islands landmark 12th tax information exchange agreement was signed with New Zealand in August 2009 moving the jurisdiction onto the whitelist of countries that have substantially implemented the OECDs internationally agreed tax standard. For Cayman tax purposes the term founder of a legal structure refers to an individual who has.

Home US terminates tax treaty over Hungarys veto to global minimum tax AdobeStock_443729860. G the term enterprise applies to the carrying on of any business. Not only is there automatic financial reporting to the home jurisdiction of every account of a Cayman Islands entity under US Foreign Account Tax Compliance Act FATCA and the Common Reporting Standard but HMRC the IRS and almost every other tax authority of relevance has unrestricted access in the Cayman Islands under the tax information exchange.

Taxes of every kind and description. Ireland and Kosovo signed a new DTA on 25 June 2021. 15 December 2010 for other taxes.

All taxes except customs tariffs. A common misunderstanding of US citizens and green card holders living in the Cayman Islands is that they do not need to file US income tax returns if their earned income is less than the foreign earned income and housing exclusions discussed below. This Agreement shall apply to the following taxes imposed by the Contracting Parties.

They have no income tax no property taxes no capital gains taxes no payroll taxes and. If you are a dual resident taxpayer and you claim treaty benefits as a resident of the other country you must timely file a return including extensions using Form 1040NR US. Tax treaties See the Other issues section in the Corporate summary for a description of Bilateral Agreements that the Cayman Islands has entered into.

For the purposes of this Agreement unless otherwise defined. A in the Peoples Republic of China. Its provisions entered into effect on 1 January 2022.

A in the case of the United States all federal taxes. Since no income taxes are imposed on individuals in the Cayman Islands foreign tax relief is not relevant in the context of Cayman Islands taxation. The Multilateral Convention on Mutual Administrative Assistance in Tax Matters which allows tax information exchange with more than 140 countries.

Cayman Islands Tax Neutrality Overview Cayman Finance

Cayman Islands Publishes Faqs On Economic Substance Orbitax News

Deals Canada Signed To Catch Tax Cheats Allow Billions In Taxes To Escape Cbc News

Us Ch Pension Plans And Treaty Benefits Kpmg Global

Double Tax Treaties In The Cayman Islands Archives Cayman Company Formation

/shutterstock_98009558-5bfc477846e0fb0051823da0.jpg)

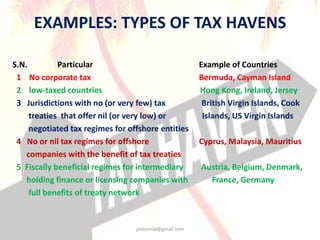

Tax Havens All You Need To Know

:max_bytes(150000):strip_icc()/CIA_map_of_the_Caribbean-822e94431d4647ba9ca350ebf28eb23b.png)

Top 10 Offshore Tax Havens In The Caribbean

Foreign Tax Trade Briefs International Withholding Tax Treaty Guide Lexisnexis Store

What Makes Cayman Islands So Popular For Hedge Funds International Finance

Here Are Some Of The Most Sought After Tax Havens In The World

What Is The Global Minimum Tax And How Will It Impact Cayman Cayman Compass

In Wake Of Brexit Eu To Put Cayman Islands On Tax Haven Blacklist Cayman Islands The Guardian

Expat Cayman Islands Expat Intelligence

Tax Havens Major Tax Havens Around The World

Us Cayman Sign Tax Treaty Nationnews Barbados Nationnews Com